MyLowesLife is the official portal that can be accessed by current and former Lowe’s employees. Users registered with the company are able to access the portal by visiting this benefit and taking advantage of all the services offered by the company.

The MyLowesLife portal offers a variety of employee benefits based on predetermined criteria. While logged in, the portal provides you with specific fields of criteria to choose from. Following your selection, you’ll be able to see the programs linked to them. The following criteria apply:

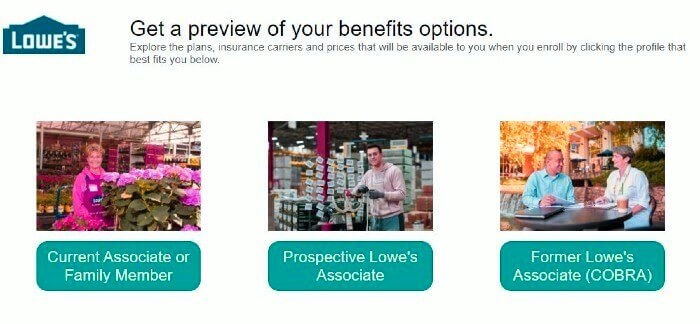

- The selection of an employee’s status is divided into three choices here. There are three categories: Current Associate or Family Member, Prospective Lowe’s Associate, and Former Lowe’s Associate.

- This field refers to your work schedule as full-time or part-time. The way you work determines whether you are a full-time or part-time employee.

- To preview the plans, you need to enter your zip code in the Home Zip Code field.

Once you have entered all the information requested and clicked on “Explore Your Options,” you will be directed to a page that provides information about your plan and benefits.

With a family of employees second to none, Lowe’s is proud to have built a culture of diversity within the company. Lowe’s employee benefits plan includes health and dental insurance, flexible spending accounts, a vision insurance plan, sick pay, vacation, paid holidays, disability, life insurance, a prescription drug plan, and a part-time employee medical plan.

To help employees and those considering employment at Lowes, Lowes has created a benefits estimator tool. When enrolling, you will be able to learn more about the plans, insurance carriers, and prices available to you.

Following are the various employee benefit programs:

- The company offers a variety of health care and drug coverage options, such as telemedicine, diabetes management, and a dedicated family nurse practitioner.

- A full range of dental services.

- Vision coverage

- Health Savings Accounts and Flexible Spending Accounts

- Plans such as 401(K), benefit restoration, and cash deferral

- ESPP (Employee Stock Purchase Plan)

- Insurance for short-term disability

- Insurance for long-term disability

- Dependent Life Insurance

- Insurance for off-the-job accidents

- Health Insurance for Critical Illness

- Indemnity insurance with a fixed amount

- Employer-sponsored life insurance

- Commuter and dependent care flexible spending accounts

- Accidental Death and Dismemberment Insurance